Our world constantly bombards us with screens and digital devices. This means that taking care of our eyes has become more important than ever. What exactly is vision insurance, and why is it crucial for maintaining good eye health? In this article, we'll delve into the basics of vision insurance, how vision insurance works, the vision and eye services it covers, and why it's essential for maintaining optimal eye and whole-body health.

Understanding the Basics of Vision Insurance

Vision insurance is a specialized form of insurance coverage that helps you maintain your eye health and vision while safeguarding your overall well-being. Just as health insurance protects you against medical expenses, vision insurance focuses specifically on your eye care needs.

How Vision Insurance Supports Eye and Whole-Body Health

Your eyes play a crucial role in your daily life, enabling you to see the world around you and enjoy various activities. Good vision is not only essential for your daily routines but also for overall health. Here's how vision insurance helps support your eye and overall health:

1. Preserving Eye Health with Regular Eye Exams and Screenings

Regular eye health screenings are a foundation of maintaining optimal vision. Vision insurance typically covers the costs of these eye exams and screenings, allowing you to detect potential issues early on. According to the American Academy of Ophthalmology, routine eye exams can identify eye diseases like glaucoma, macular degeneration, and diabetic retinopathy before they cause significant damage.

2. Seeking Professional Care

Vision insurance encourages individuals to visit eye care professionals like optometrists or ophthalmologists regularly. These vision experts can identify signs of eye diseases or conditions that might otherwise go unnoticed. Regular eye doctor visits also provide an opportunity to get advice on maintaining eye health through proper nutrition and lifestyle choices.

3. Addressing Eye Health Concerns Promptly

With vision insurance, you're more likely to address any eye health concerns promptly. Timely eye and vision treatment can prevent conditions from worsening and help maintain your vision for the long term.

4. Detecting Whole-Body Health Conditions

Regular eye exams can detect many health conditions that do not originate in the eye. According to the American Academy of Ophthalmology, problems spotted in the eye are often a sign of disease elsewhere in the body. An eye doctor may be able to detect the signs of conditions such as skin cancer, high cholesterol, Lyme disease, and many more.

The Consequences of Not Having Vision Insurance

Without a proper vision insurance plan, individuals are less likely to prioritize regular eye health screenings and visits to eye care professionals. This can have significant consequences for both eye health and overall well-being:

1. Neglecting Regular Eye Screenings

The lack of vision insurance can lead to fewer regular screenings, increasing the chances of missing early signs of eye diseases. According to the National Eye Institute, vision problems can often develop silently without noticeable symptoms, making screenings crucial for early detection.

2. Reduced Access to Eye Care Professionals

Without insurance coverage, the cost of visiting an optometrist or ophthalmologist may discourage individuals from seeking help when needed. This can result in delayed diagnosis and treatment, potentially leading to irreversible vision damage.

3. Limited Access to Prescriptive Eyewear

Vision insurance often covers the costs of prescription eyeglasses and contact lenses. Without this coverage, individuals might be hesitant to invest in corrective eyewear, which can lead to eye strain and discomfort in everyday tasks.

Costs of Vision Insurance and Long-Term Savings

While a vision insurance plan comes with a cost, the benefits will nearly always save you money in the long run:

1. Basic Costs of Vision Insurance:

The cost of vision insurance varies depending on the level of coverage and the provider. However, considering the potential expenses associated with eye care, vision insurance offers a cost-effective way to manage your eye health.

2. Yearly Eye Exams, Screenings and Preventive Measures:

Vision insurance covers yearly eye exams, screenings, and preventive measures that can help you catch eye health issues before they become more serious. Investing in preventive eye care can save you from extensive medical costs in the future.

3. Savings on Eyewear and Minor Surgeries:

Vision insurance often includes coverage for prescription eyeglasses, contact lenses, and even minor eye surgeries if necessary. This coverage can significantly reduce your out-of-pocket expenses for essential eye care needs.

Finding Quality Vision Insurance Plans

Now that we've established the importance of vision insurance, how do you go about finding the right vision insurance plan?

Research various vision insurance plans, comparing coverage, costs, and network of eye care professionals. Look for vision plans that align with your specific eye care needs.

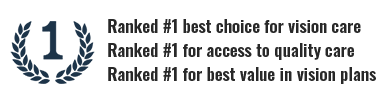

It’s important to look for a vision insurance plan that includes a network of reputable eye doctors in your area. This ensures you have easy access to quality eye care services. With VSP insurance, you’ll have access to a huge network of eye doctors all over the country.

Conclusion: Prioritize Your Eye Health with VSP Vision Insurance

Is having vision insurance worth it? When it comes to ease of maintaining your eye health, absolutely. VSP insurance has everything for complete vision health, including vision correction allowances, preventive health screenings, annual eye exams, and more. With providers across the country, it’s easy to find a location near you.

Get started today! The VSP Vision Plan Wizard can find the vision plan that’s right for you and your family.

Remember, healthy eyes contribute to a healthier you. So, take the first step toward clearer vision and a brighter future by exploring the world of vision insurance today. Your eyes will thank you, and your whole body will benefit.

Your vision. Your way.

Not covered for vision? Get an individual plan, customized for you – including where you want to use it: at the doctor, in a retail location, or even online.

Losing Health Insurance at 26? Here Are Your Options

While each birthday is a reason to celebrate, turning 26 can mean you’ll need to make an important decision for your health insurance coverage...

5 Summer Glasses Frame Options

Summertime means vacation time, patio-dining in the evening with friends and family, and updating your “what to wear” outdoor wardrobe f...

Commonly Asked Questions About Your Vision Plan

Many people wait until the end of the year to use their vision insurance benefits, but you shouldn’t always put it off, right now may be time ...